tax filing san diego

Married filing separately and compile your projections into sleek easy-to-read presentations. If you are blind disabled or 62 years of age o.

California Sales Tax Small Business Guide Truic

You still have the option to.

. San Diego County has one of the highest median property taxes in the United States and is ranked 168th of the 3143 counties in order of median property taxes. San Diego County Assessor. NEWS RELEASE SUMMARY August 19 2022.

Before applying for a Discretionary Permit or review applicants can request a Preliminary Review. Insights to your clients. Looking for FREE property records deeds tax assessments in San Diego County CA.

Visit Limited Liability Company Filing Information FTB 3556 for more information. Steps to Franchise Tax Return Filing. However if the citation is dismissed Parking.

San Diego Residential Property Management is dedicated to the principle of equal access for people with disabilities in compliance with the Americans with Disabilities Act ADA and HUD guidelines. SAN DIEGO Elliot Adler an attorney and founding partner of a boutique San Diego law firm was sentenced in federal court today to one year and one day in custody for conspiring with former Chabad of Poway Rabbi Yisroel Goldstein to. Appellate Defenders Inc is a non-profit law firm which administers the appointed counsel system for the California Court of Appeal Fourth Appellate District in California.

Discretionary approvals require a decision-maker to exercise judgment. Recorder and Clerks Office fictitious business names including requirements filing information fees and payment. All franchise tax return documents must be legible for microfilming record.

203 for refund offsets. SDGE-38-WP-R Jack M Guidi - Working Cash. The class follows a hypothetical case as well as an actual case from the perspective of all sides conducting discovery.

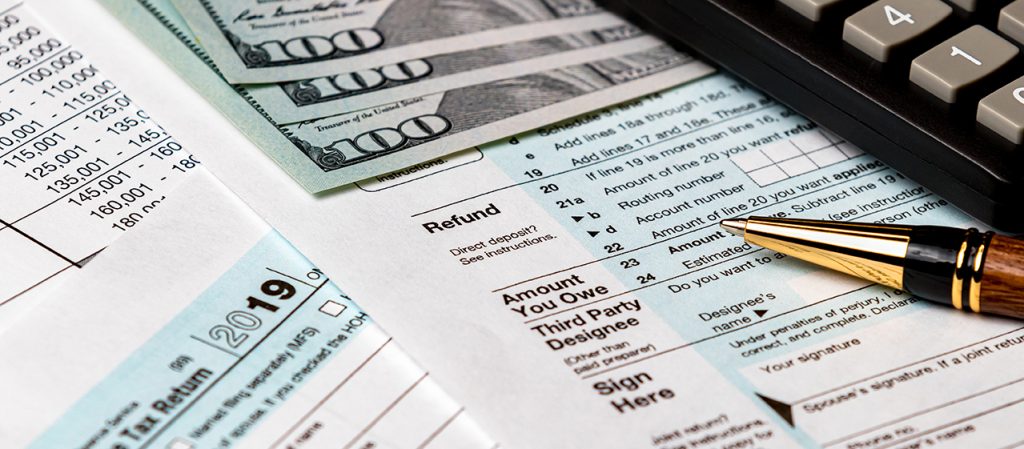

Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR and tax year 2021 or later Forms 1040-NR. Online Through your tax representative or tax preparation software Mail Franchise Tax Board PO Box 942840 Sacramento CA 94240-0001 Businesses. See Form 1040-X Amended US.

Emergency tax or fee relief is available from the California Department of Tax and Fee Administration CDTFA for business owners and feepayers directly affected by disasters declared as state of emergencies. If the citation is upheld the Court keeps the 25 Civil Court Filing Fee and Parking Administration keeps the citation fees previously deposited to satisfy the citation. Valerie Chu 619 546-6750 and Michelle L.

Tax year 2016 and before. Every LLC that is doing business or organized in California must pay an annual tax of 800. County of San Diego Board of Supervisors.

The steps to filing an Oklahoma Franchise Tax Return involve a line-item reporting of the businesss annual return and balance sheet income. Document Filing Support PO Box 944228 Sacramento CA 94244-2280. These are the steps business owners must take in order to file their franchise tax return.

Individual Income Tax Return Frequently Asked Questions for more information. San Diego 7575 Metropolitan Dr Room 210 San Diego CA 92108 619 220-5451 LaborCommWCASDOdircagov. Online competitor data is extrapolated from press releases and SEC filings.

PO Box 129038 San Diego CA 92112-9038. San Diego Gas Electric Company is a subsidiary of Sempra. Quickly search property records from 31 official databases.

Copy of original return 540 540NR 540 2EZ 2. For questions about filing extensions tax relief and more call. SAN DIEGO COUNTY - 9900 DIVORCE - SE HABLA ESPANOL pic hide this posting restore restore this posting favorite this post Sep 7 SUBMITYOURCASEORG - ANY LEGAL ISSUE - CALL 1-800-726-1738.

Find the highest rated Tax Planning software pricing reviews free demos trials and more. SDGE and San Diego Gas Electric are registered. The median property tax in San Diego County California is 2955 per year for a home worth the median value of 486000.

They work 6 days a week over 10 hour days to receive a paystub for 40000 minus tax deductions and description of pay is commissions. San Diego County collects on average 061 of a propertys assessed fair market value as property tax. Contact us today for a complimentary case evaluation.

In this course the non-tax aspects of estate planning are integrated combining wills trusts future interests and. As defined in the San Diego Municipal Code Discretionary Permits and processes are required when developments may impact the surrounding area due to a proposed use design feature or project location. You may call the IRS at 800-829-1040 see telephone assistance for hours of operation to discuss any IRS bill.

Filing a wage complaint with the labor board can take as little as 30 minutes on the phone. 143 MB PDF SDGE-38-WP-R Jack M Guidi - Working Cash. The office operates under a contract with the California Administrative Office of the Courts.

1 online tax filing solution for self-employed. General Recording Information español. In addition any future federal tax refunds or state income tax refunds that youre due may be seized and applied to your federal tax liability.

Voted Best Tax Attorney in San Diego. Online is defined as an individual income tax DIY return non-preparer signed that. Run analyses that take into account multiple scenarios such as comparing joint vs.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. 540X for that tax year find in our form locator and related supporting documents. 18 MB PDF Application.

Submit your amended return online or by mail. Pay Your Property Taxes. State law requires Social Security numbers in order to ensure that homeowners receive only one exemption.

You can file Form 1040-X Amended US. News about San Diego California. Self-Employed defined as a return with a Schedule CC-EZ tax form.

This yearly tax will be due even if you are not conducting business until you cancel your. Mariposa San Bernardino and San Diego. Learn more about RJS LAW 619 595-1655.

Non-Party Discovery and Preservation of Testimony or Evidence Before Filing an Action is also covered. Between now and early October when voting gets underway The San Diego Union-Tribune Editorial Board is planning to publish dozens of candidate QAs and nearly. San Diego CA 92101 1 858 454-5900.

Parcel Property Characteristics Search. Business Tax CertificateLearn More. The Courts decision is final.

SDGE-37-WP-R Ragan G Reeves - Tax.

Free Tax Preparation United Way Of San Diego County

Catholic Charities Tax Preparation

How To File Taxes For Free In 2022 Money

Catholic Charities Tax Preparation

What Are 1095 Tax Forms San Diego Sharp Health News

Doing Business City Of San Diego Official Website

Maac Volunteer Income Tax Assistance

Blanco Tax Law Jesse Blanco San Diego Tax Attorney Serving The San Diego Community And International Clients For Over 13 Years

Codes Regulations Development Services City Of San Diego Official Website

Irs Office San Diego Phone Appointments Parking Hours Services

Property Tax Calculation For San Diego Real Estate Tips For Homeowners

San Diego County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Understanding California S Property Taxes

What Are California S Income Tax Brackets Rjs Law Tax Attorney

San Diego County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates